This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How the recent “stealth taxes” may affect your wealth, and why you shouldn’t underestimate them

7th June 2023

For the past three years, many aspects of your financial life may have shifted significantly.

While you may have saved up more than usual during the Covid-19 lockdowns, 2022 brought a new set of challenges, including double-digit inflation, rising interest rates, and soaring energy prices.

One aspect of your expenditure that may also have risen, perhaps more subtly than the other areas mentioned above, is tax.

While the rate of tax you pay might not have increased directly, the Evening Standard reports that HMRC’s tax receipts showed a 9.9% overall increase in 2022/23 compared to the previous year.

Although some of this increase might simply reflect a return to normal consumer activity last year, there’s another factor at play: a phenomenon known as “stealth tax”.

Keep reading to find out what stealth taxes are, how they might affect your finances, and what you can do to improve your situation.

“Stealth taxes” describe an indirect increase in taxation that often goes unnoticed

On reading about the increase in tax receipts taken by HMRC, you could be wondering: “if my rate of tax hasn’t gone up, why would my bill do so?”

There are various exemptions and allowances under which you don’t usually pay any tax. For instance, as of 2023/24, the Personal Allowance protects your first £12,570 in earnings from Income Tax and National Insurance contributions (NICs).

Crucially, the Government has frozen or reduced a number of these tax-efficient allowances, meaning more people are likely to breach them as their overall earnings increase.

These freezes and reductions are known as “stealth taxes” because they indirectly increase many people’s tax liability without actually hiking the official rate at which the tax is paid.

3 tax-efficient allowances and exemptions that have been frozen or reduced in the 2023/24 tax year

If you are concerned that the current stealth taxes could be set to increase your bill this year or in future, it’s essential to know which areas might be most harshly affected.

So, here are three of the tax-efficient allowances and exemptions that the Government has either frozen or reduced recently.

1. The Capital Gains Tax annual exempt amount was reduced in April 2023

You usually pay Capital Gains Tax (CGT) on profits you earn from selling:

- Non-ISA shares

- Properties that aren’t your main residence

- Your main home if you’ve let it out, used it for your business, or it is very large

- Business assets

- Most personal possessions worth more than £6,000, excluding your car.

Between 2020/21 and 2022/23, the CGT annual exempt amount – the gains you can make before you may have to pay CGT – was fixed at £12,300, rather than rising in line with inflation.

Now, as of 2023/24, the CGT annual exempt amount has decreased to just £6,000. What’s more, it is set to halve to £3,000 in April 2024.

So, if the profits from your asset sales – including cashing in shares – have increased since the 2020/21 financial year, it is likely your CGT bill may have already risen.

Plus, now that the annual exempt amount has been reduced significantly and is set to decrease again next year, your CGT liability could rise even further.

2. The Inheritance Tax nil-rate bands are frozen until 2028

Inheritance Tax (IHT) is usually paid on a person’s estate when they pass away, if the value of their estate exceeds the IHT allowances known as the “nil-rate bands”.

Since the 2009/10 tax year, the nil-rate band has been fixed at £325,000. This covers all taxable assets.

Additionally, since 2020/21, the residence nil-rate band, which applies to property passed to direct descendants, has remained at £175,000.

Both of these allowances have been frozen until 2028.

Unsurprisingly, as a result of these freezes, IHT receipts have increased significantly. According to Money Marketing, in 2022/23 alone, HMRC took more than £7 billion in IHT – up from £5.2 billion five years before.

So, if your or your parents’ estate has appreciated in value over the years, they will have become more likely to breach the nil-rate bands, meaning a larger portion of assets may then be subject to IHT.

3. 3 key Income Tax allowances have been either reduced or frozen

Your Income Tax bill may have increased, or be set to rise in the immediate future, due to various forms of stealth tax.

Firstly, in the last three tax years, the Personal Allowance – the amount under which you do not usually pay Income Tax or NICs – has only increased by £270.

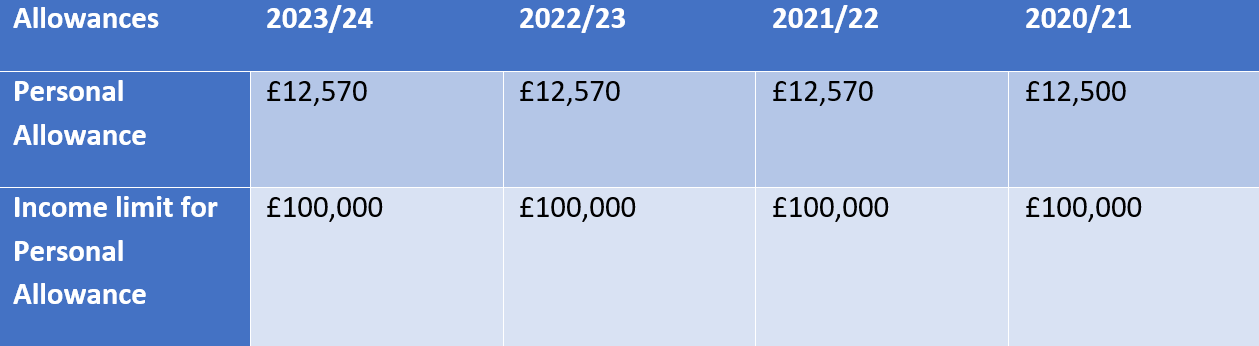

The below table shows the value of the Personal Allowance since the 2020/21 financial year. It is set to be frozen at its current level until 2026.

Source: HMRC

Crucially, research from an Institute for Fiscal Studies (IFS) thinktank, published by the Guardian, reveals this freeze will “cost most basic-rate taxpayers £500 from April, and cost most higher-rate taxpayers £1,000” when compared with allowances rising each year.

Secondly, as the table reveals, the income limit for the Personal Allowance has not changed either. For every £2 of income earned over £100,000, the Personal Allowance reduces by £1, meaning the Personal Allowance disappears entirely when an individual earns £125,140 or more.

This is extremely important to understand in the 2023/24 tax year because, on top of the income limit freeze, the Government has reduced the threshold at which you begin paying additional-rate (45%) Income Tax too.

Previously set at £150,000, the amount you can earn before paying additional-rate tax was reduced to £125,140 in the 2023/24 tax year. As more individuals’ earnings breach the £125,140 mark, the more additional-rate tax is likely to be paid to HMRC.

What’s more, the higher-rate tax band has also remained fixed at £50,271 this year – and according to a report from Professional Adviser, this freeze means 1.5 million adults could be pushed into a higher tax band by 2027.

If you are likely to be affected by the Income Tax stealth taxes in the coming years, talking to your Financial Planner sooner, rather than later, could be a constructive step.

Get in touch to learn how expert financial planning can help mitigate a tax bill

If you feel concerned about a rising tax bill after reading this article, don’t panic.

When equipped with professional insights, you could find ways to mitigate your tax bill and avoid falling into the “stealth tax” trap as best you can.

For a conversation about making your earnings more tax-efficient, email us at enquiries@pen-life.co.uk, or call 01904 661140.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

All information is correct at the time of writing and is subject to change in the future.

Category: Industry News