This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Should I open a savings account for my child or grandchild? 3 key questions answered

28th September 2023

As a parent or grandparent, you may be searching for ways to improve your children and grandchildren’s future financial security.

Leaving an inheritance can help down the line, but one way to ensure your loved ones receive funds earlier in life could be to start saving on their behalf when they’re young.

Setting your loved ones up for a secure financial future could help them to:

- Pursue education and career opportunities without worrying too much about the cost

- Start climbing the property ladder as early as possible

- Save for their own retirement.

There are numerous ways to begin building a nest egg for the next generation, so you could be wondering when and where to begin.

Read on to find out the answers to three key questions about starting a savings account for a child.

1. Should I invest or save in cash on behalf of a child?

One key question we hear all the time is: “Is saving in cash or investing on a child’s behalf better for their future?”

Of course, the answer to this entirely depends on your personal circumstances – but in general, cash savings can lose their real-terms value due to the effects of inflation. If you’re planning on putting funds away for your children to use in 10, 20, or even 30 years’ time, leaving this money sitting in cash could see its value erode.

Conversely, investing can be a beneficial tactic for growing a nest egg over the long term.

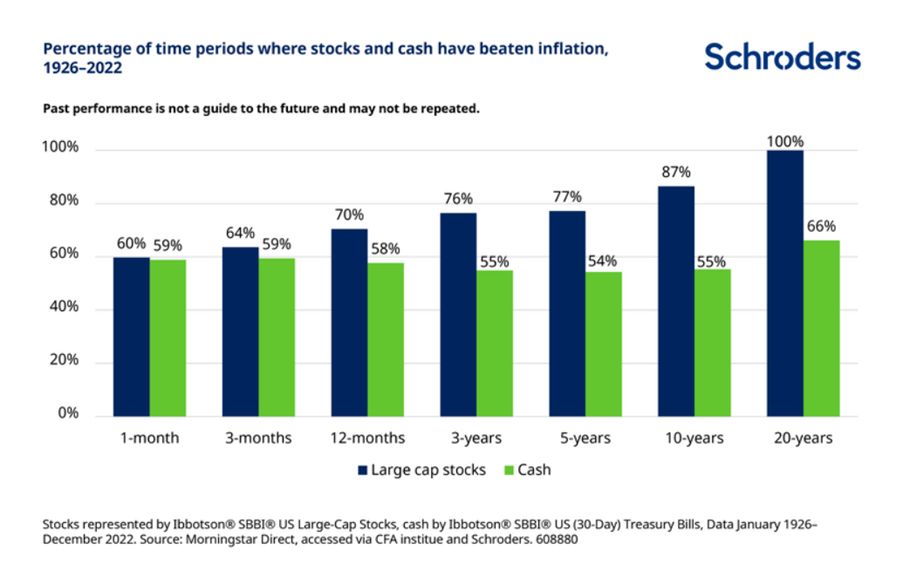

While there is a risk of loss to your capital when investing, historically, the stock market has outpaced inflation more often than cash, as the below graph shows.

Source: Schroders

As you can see, between 1926 and 2022, large cap stocks outperformed cash against inflation across all time frames shown. And, crucially, their growth beat inflation 100% of the time over a 20-year period – which is likely to be the approximate time frame of the nest egg you’re setting up.

So, it could be worth speaking to a Financial Planner about investing on behalf of a child rather than simply holding the funds in cash.

2. Can I start a pension for my child or grandchild?

A popular form of saving on behalf of a child or grandchild is to create a pension for them.

Starting a pension while a child is still young could have tangible benefits both in the short and long terms.

In the short term, if your child has already built up a substantial pot by the time they begin earning, their pension contributions could be more effective in nurturing that pot through compound growth.

In addition, long-term, your child could enter retirement with the confidence that they have enough to sustain their lifestyle.

For instance, an Investors’ Chronicle report found that “£300 a month invested between a child’s birth and age 18, assuming 20% basic-rate tax relief on contributions, investment growth of 5%, and charges of 1%, would grow to £581,240 by the time they reach 65”.

Remember: if you start a pension pot for your child, they are unlikely to be able to access these funds until they are in their 50s or 60s.

So, if you want to help them earlier in life too, it could be wise to split your savings between their pension and another form of investment or cash account. In doing so, you may be able to provide your child with multiple injections of capital throughout their life, not just one big pot at the end of their career.

3. Will I be taxed, or receive tax relief, if I make savings on behalf of a child?

It’s essential to understand how making savings on a child’s behalf might have an impact on your (or their) tax bill.

Here is a short breakdown of how this might work.

Tax on child pensions

As of 2023/24, parents and grandparents can pay up to £2,880 net (£3,600 gross) into a pension fund for a child or grandchild under 18 each tax year while benefiting from tax relief.

If the child has earnings, you can pay tax-relievable contributions of up to £60,000 a year, or 100% of the child’s earnings, whichever is lower.

Tax on cash savings on your child’s behalf

In 2023, cash savings have begun returning favourable interest payments after more than a decade of low rates. In August, the Bank of England (BoE) raised the base interest rate to 5.25%, and maintained it at this level throughout September. As a result, many banks and building societies are offering more than 5% returns on cash savings, Moneyfacts reports.

While beneficial, these high returns could push the interest payments on your own cash savings over your Personal Savings Allowance (PSA) limit, meaning you could pay Income Tax on the amount returned.

As of the 2023/24 tax year, the PSA is as follows:

- If you’re a basic-rate taxpayer, you can earn £1,000 a year in interest before paying Income Tax.

- Higher-rate taxpayers benefit from a PSA of £500.

- If you’re an additional-rate taxpayer, you do not have a PSA.

Crucially, if you’re paying into a savings account on behalf of your child, the rules are a little different.

Once a child’s savings account earns more than £100 in interest payments, the money is treated as if it were the parent’s, and is usually taxed accordingly.

This means that if your own interest payments, plus your child’s £100 in interest, reach the limit of your PSA, you may begin paying Income Tax on the interest you and your child earn above that sum.

Junior ISAs

If you’re investing outside of a pension on your child’s behalf, it could be tax-efficient to do so within a Stocks and Shares Junior ISA (JISA). As of 2023/24, the JISA contribution limit is £9,000.

Crucially, any profits made within a JISA, just like other types of ISAs, are free from Capital Gains Tax (CGT) and Income Tax. This means that you could potentially nurture a growing pot of wealth on your child’s behalf until they are 18, at which point they are able to withdraw the funds as they wish.

Get in touch to begin planning your loved ones’ financial future

The options you’ve read about here are just a few of the many ways you can build up savings on behalf of a child or grandchild.

Working with a Financial Planner when creating a nest egg for the next generation can help you assess a broad array of options, and may empower you to make an advantageous choice for your family.

To learn more about how we can help, email us at enquiries@pen-life.co.uk, or call 01904 661140.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

All information is correct at the time of writing and is subject to change in the future.

Category: Industry News