How to make the most of your ISAs, and why they matter

16th November 2023

Individual Savings Accounts (ISAs) have many benefits that make them a hugely popular avenue for saving and investing.

One of the key advantages to ISAs is that these accounts are tax-efficient. Any interest, top-ups, or investment returns you receive within these accounts are protected from Income Tax and Capital Gains Tax (CGT), unlike most other saving and investment accounts.

As such, ISAs are often used to put funds away for the future, including:

- Buying a home

- Retirement

- Later-life bills, such as residential or nursing care.

With various tax thresholds being frozen and interest rates on the rise, many people are searching for ways to preserve their wealth tax-efficiently – so perhaps it is unsurprising that the number of people opening Cash ISAs has increased this year.

Indeed, Money Marketing reports that one bank saw a 73% increase in Cash ISA subscriptions compared to the previous year. Plus, further data reveals there was a 55% uptick in the amount being deposited into Cash ISAs between January and May 2023.

With all this in mind, you may be looking to make the most of your ISAs in the future – and if so, learning how to do so efficiently could boost your savings even further.

Keep reading to find out easy tips for using your ISAs to grow your wealth, and how we can help you make the most of yours.

ISAs have an annual “use it or lose it” allowance – so planning ahead is essential

There are five types of ISA, all of which are designed to serve a different purpose. These include:

- Cash ISAs, which may operate similarly to other cash accounts you hold, with easy access and fixed-term options available.

- Stocks and Shares ISAs, in which you can invest your money with a view of seeing long-term tax-efficient growth.

- Lifetime ISAs (LISAs), designed for first-time homebuyers and retirement only. A LISA must be opened before the age of 40, and the funds you put in receive a 25% Government top-up. Withdrawals made for any reason other than buying your first home or retirement are subject to a 25% charge.

- Innovative Finance ISAs (IFISAs), which enable you to lend funds in a peer-to-peer scheme and earn interest.

- Junior ISAs (JISAs), which can be opened on behalf of a child and accessed by that person when they turn 18.

As of the 2023/24 tax year, the total amount that can be paid into all your ISAs (with the exception of a JISA, as this technically belongs to your child) is £20,000. This limit is set by the Government, and is subject to change in the future.

Crucially, this “umbrella allowance” covers all ISAs other than JISAs. The JISA limit is entirely separate, and stands at £9,000 in 2023/24.

For example, if you held a Cash ISA and a Stocks and Shares ISA and paid £2,000 into your Cash ISA, you could then only pay up to £18,000 into either of your ISAs for the remainder of that tax year. You can only pay into one of each type of ISA in a single tax year.

Some ISAs have their own contribution limits too; for instance, the annual LISA limit is £4,000, which forms part of your overall £20,000 allowance.

Perhaps most importantly, though, remember that these are “use it or lose it” allowances. Once the tax year is over, any remaining contribution opportunities will not roll over.

With this in mind, planning your ISA contributions could be constructive. Working with a Financial Planner can help you figure out how much you’d like to pay into your ISAs each year, and how you can spread these savings and investments out if you hold multiple accounts.

Paying into your Stocks and Shares ISA at the start of the tax year can help maximise long-term returns

Using a Stocks and Shares ISA to make tax-efficient investments can be extremely beneficial as you look ahead towards retirement. You can invest at any time – just remember that your ISA allowance resets at the start of the new tax year in April.

Although it may seem like common sense, many people forget that paying into your Stocks and Shares ISA at the start of the tax year, rather than the end, could help maximise long-term returns. The longer your money is invested for, the greater the opportunity for growth.

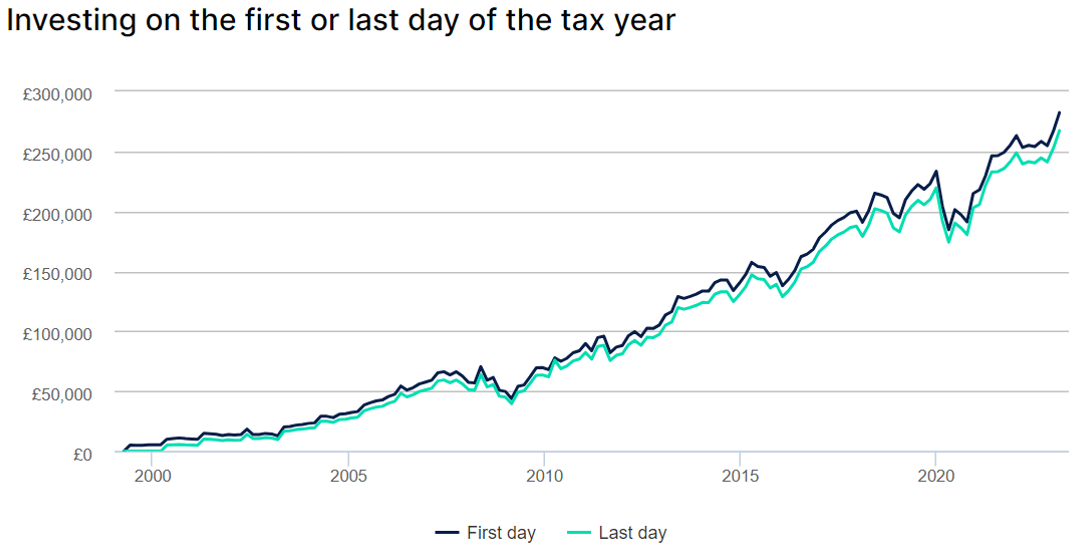

Indeed, the below graph shows that if two savers paid an equal amount of £5,000 a year into a Stocks and Shares ISA between 1999 and 2023, those who invested at the start of each year would be £9,587 better off overall.

Source: HL. Includes 2022/23 subscriptions for both.

So, if you’re reviewing your financial plan between now and the new tax year in April 2024, it could be wise to prioritise making Stocks and Shares ISA contributions as early as you can.

While past performance is not a reliable indicator of future performance, and returns are never guaranteed, routinely investing at the start of the tax year could boost returns in the long term.

Including ISAs as part of your financial plan could help you remain on track for later life

If used as a retirement savings tool, ISAs could become an integral part of your later-life income.

The opportunities for tax-efficient compound returns could mean that your wealth grows amply within these accounts, and is all yours to keep when you decide to use the money later.

Sadly, according to a study published by MoneyAge, two-thirds of Brits do not feel confident about their retirement. If you’d like to utilise your ISAs efficiently in the run-up to this milestone, but aren’t sure what opportunities are available, we can help.

A Financial Planner can:

- Factor your ISA savings into your overall financial plan

- Look at the time frame over which you’d like to pay into your ISAs and offer guidance on making contributions within it

- Give advice as to spreading your payments across multiple ISAs while remaining within your allowance.

For professional guidance on ISAs, or any other financial matter, get in touch with us today. Email at enquiries@pen-life.co.uk, or call 01904 661140.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

All information is correct at the time of writing and is subject to change in the future.

Category: Industry News